However there is an aspect of the appraisal fee that could be considered an ordinary and necessary expense of doing business in this case.

How do you depreciate a new roof on a rental property.

Depreciation starts when you bring the new roof into service.

You need to calculate the value of the old roof when it was new or when you bought your rental property.

To do it you deduct the estimated.

Generally each year you will report all income and deduct all out of pocket expenses in full.

This means the roof depreciates 545 46 every year.

Correct normally these are either added to the basis or amortized over the life of a loan.

The most straightforward one typically used for home improvements is the straight line method.

Are in the same class of property as the residential rental property to which they re attached.

For example if you ve owned a rental property for 10 years before you installed a new roof you can depreciate the roof over 27 5 years even though you have 17 years of depreciation left on the property.

Depreciation ends after 27 5 years when you have fully recovered the cost of the new roof.

For example if the new roof costs 15 000 divide that figure by 27 5.

Are generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

If the property is unoccupied you bring the roof into service when you next lease the rental property.

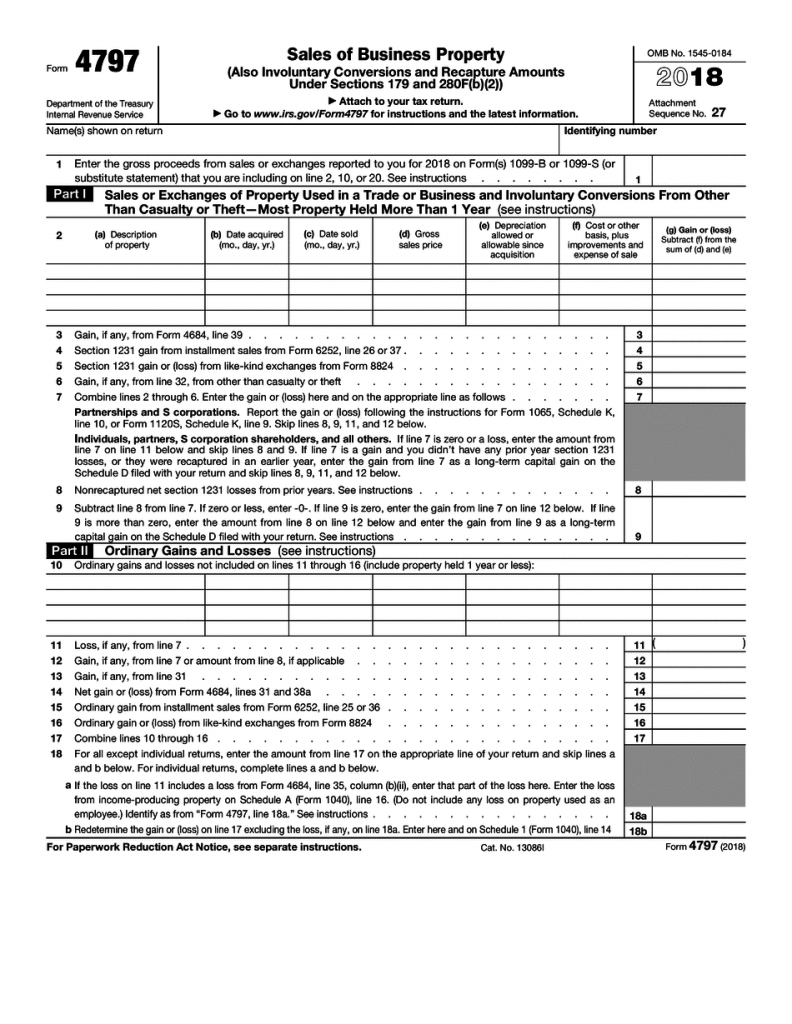

The deduction to recover the cost of your rental property depreciation is taken over a prescribed number of years and is discussed in chapter 2 depreciation of rental property.

You use the consumer price index numbers available online to figure this value.

Can i use a special depreciation allowance for a new roof for a rental property.

If the property is tenanted you bring the roof into service on the day you install it.

In contrast if you need to replace the entire roof you would depreciate it over the useful life of the roof which is 27 5 years the same as the property to which its attached determined by the irs depreciation schedule because replacing the roof is not a repair but is considered an improvement.

Then you use turbotax to sell dispose the old roof and manually reduce the remaining depreciation of the building on the appropriate turbotax screen.